29 March 2024

Request your demo of the Sigrid® | Software Assurance Platform:

3 minute read

Driving innovation through acquisition:

Why transparency into software assets is crucial throughout the entire transaction lifecycle

Technology has become a key differentiator for organizations in every major industry, worldwide. Banks rely on software systems that handle billions of transactions each day, governments continuously digitize and automate services that were previously hard manual labor and energy companies depend on telemetry of software to speed up their energy transition in a safe way.

The quality of that software is equally important as the functionality of it. Time and time again, it’s proven that the smallest mistake in software code can have disastrous effects on the financial health and reputation of a company. So it’s easy to see why investors, private equity and M&A teams alike, now also have an increasing interest in the technologies and software assets they’re buying into when investing in new companies.

The thing is, it’s hard to get full transparency into software – not to mention everything that comes with it, like the development teams – when investing in a company. (Did you know: The amount of code in a single asset can be so immense, that if you were to print it out, the stack of paper would reach the Earth’s stratosphere!)

This is why most investors simply conduct interviews and review documentation when performing due diligence on these critical assets. Although necessary, these practices are far too superficial because you will never understand the true scalability, flexibility and future risks of the software if you don’t have a 360-degree-view of the code itself.

The lifecycle of a transaction typically follows a 1. Invest 2. Add value 3. Divest process, with the second phase typically being longest, ranging years. The IT assets in all of those cycles are under management by the investor and therefore need careful consideration.

Software Improvement Group (SIG) exists with the sole purpose of helping organizations get their software right for a healthier digital world. We objectively measure, analyze, monitor each line of code against several quality models that predict the current stability and future proofness of the assets. Whether the transactions focus on only one software system or an entire landscape of many different technologies that are tightly coupled, our experts can provide you with actionable advice, from bit to boardroom.

When eyeing a company for potential acquisition, an investor needs deep-dive visibility into its IT assets to understand how its software will affect its ability to grow and thrive. And that means, he/she needs to know what’s going on in the code itself.

At SIG, we deliver independent, impartial insights that enable you to determine the intrinsic economic value of the target company’s system(s) for a stronger negotiation position; identify risks hidden in the source code to better understand the cost implications of the application(s); and gather crucial input on other due diligence streams, including Financial, Legal and Commercial.

After a successful transaction, the target company and its software assets become part of the investor’s portfolio. During this growth phase, it’s crucial to monitor all code changes to keep a close eye on deviations from the plan.

know key technical personnel and understand all technical details of the software and investment objectives of the investor. Only then can controls be installed and KPIs set that relate to ISO quality standards and formulate a roadmap containing both risk mitigation and value creation milestones.

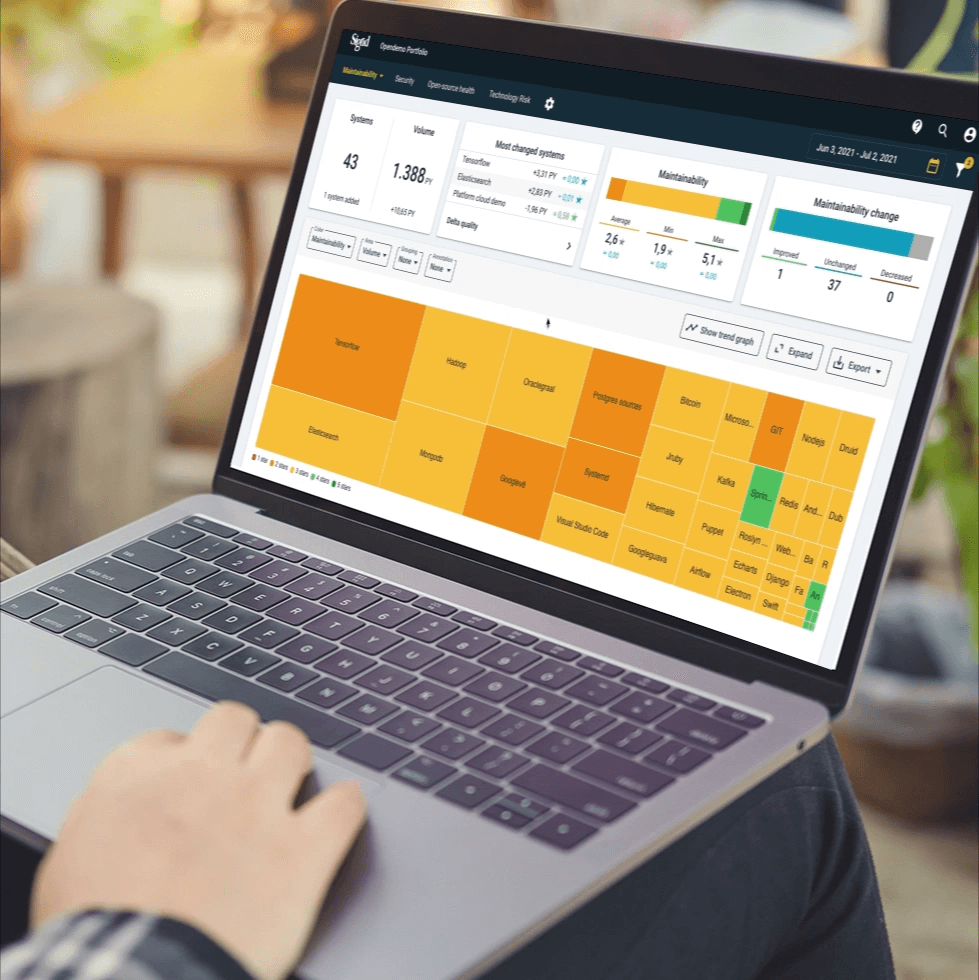

This approach goes above and beyond typical quality assurance, where only the functionality and processes are rigorously assessed. Like our IT due diligence, we start with analysis of the software itself from the developer that builds the product and work our way up to the CFO that manages the budget. We do this by applying the same certified quality models. We also use our specialized platform Sigrid which is geared toward development teams, architects, management and our own consultants giving them crucial insights and feedback on the progress of the roadmap. During this monitoring phase, SIG will be an active participant in steering committees, brainstorms and always making sure the right thing is done in the right time, ensuring a strong outcome when closing in on the divesture.

When it’s time to exit, the investor needs to prepare for a smooth transition to the new owner. And for that, we provide a balanced sell-side due diligence report As an independent partner we can provide you with a balanced Vendor Due Diligence report. We built up extensive knowledge on all software assets and how the team faced different challenges on increasing the value of those assets. Additionally, we reserve time for potential buyers to walk them through our report and do a Q&A. We even have the unique capability to certify software assets according to the ISO/IEC 25010 standard for product quality – if the assets meet the required quality level. A more formal way of displaying the code quality of the product is not possible in the IT industry!

The goal of those methodologies is to make software quality, risk and opportunities measurable, tangible for executive management. In order to be able to analyze in accordance to these quality models, an organization must have a certified laboratory. We therefore have the necessary an ISO 17025 certification. This quality standard guarantees that our measurements are reliable and replicable.

We'll keep you posted on the latest news, events, and publications.