29 March 2024

Request your demo of the Sigrid® | Software Assurance Platform:

3 min read

Written by: Maarten Stemvers

More than a decade after the 2008 global financial crisis, financial institutions now find themselves in a new world with a new set of challenges – and a highly-opinionated society.

The industry is trying its utmost to rebuild the trust and public goodwill lost as a result of quite a few substantial scandals (for instance, the reselling of bad mortgages, exorbitant executive bonus programs and money laundering). All this brings about a need to modernize, and banks, in particular, are facing the ever-present need to lower their cost/income ratio. Low interest margins, increased compliancy regulation and fiercer competition from non-banks have hurt revenue growth and profitability, leading them to slash costs. A third challenge is the value chain that’s becoming ever-more specialized due to evolving technology. Unable to move or innovate fast enough, banks are looking around for the next upcoming fintech to swallow into their innovation portfolio. The upside is that it fuels innovation.

As financial institutions, in essence, became IT companies, we at SIG see not only these new emerging technologies and the run for their functional use, but also the accompanying challenge they present to companies, like integration with existing (legacy) systems. It will come as no surprise that software – and with that its quality – plays a crucial role in all of this.

A digital compass

Every entrepreneur dreams of having lots of customers. It’s an ingredient for ultimate continuity, capital, innovation and profit. But serving all these customers according to their needs is the tricky part. The larger the number of customers, the bigger the systems needed to administer and serve them, not to mention the additional demands imposed on these companies by governing bodies as their social responsibility grows.

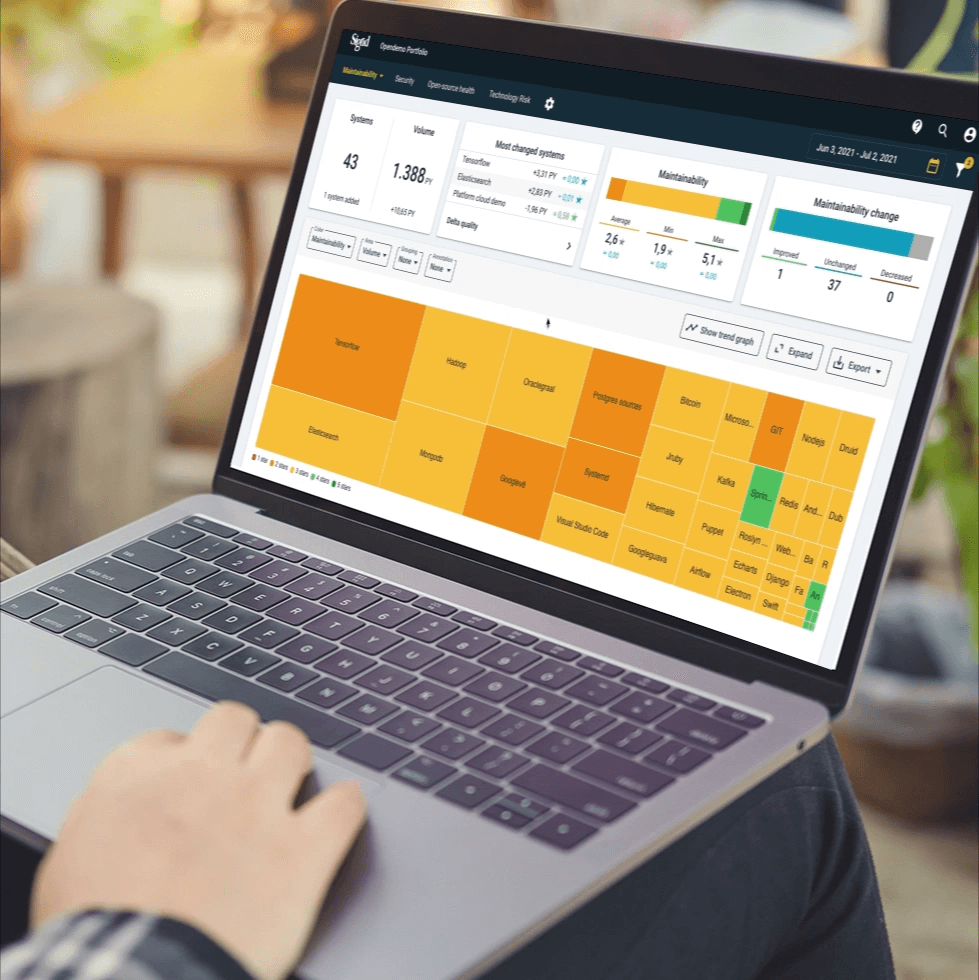

The cost that comes with maintaining the growing landscape of applications rises, at least linearly with the number of applications, and often more. Reduced insight due to increasing complexity is often a bonus. The challenge is to minimize these maintenance costs so that more can be spent on innovating them or developing new services. An overview of technical insight is what’s needed here.

SIG helped one customer tackle this challenge by optimizing the balance between maintenance and innovation within their existing IT budgets, giving them a “digital compass.” We provided them with an overview of their application landscape and application interface dependencies. We then indicated where they should focus on improving first, the so-called “hotspots,” given the expected benefits in combination with the importance to their business processes. This enabled them to allocate more budget to innovation without increasing their total spend.

A stronger leg(acy) to stand on

Typically, large banks have legacy. That’s one of the reasons which keep them from innovating on a faster scale than they currently do. The cost of a legacy overhaul and risk of a botched upgrade often leave them hesitant to address the problem, so mainframes sometimes remain untouched and ‘Don’t touch the code!’ policies are rolled out. It’s only occasionally we encounter a strategy where an old language, like Cobol, is made sexy again by investing in young people and offering them a career path as a developer to work in it.

Another client of ours, a large American bank, took a different approach: they wanted to find out whether it was possible to reengineer some of that old code and turn it around into new fresh technology-based functionality, like for instance Java, opening up new possibilities as well.

Our consultants helped this customer by not only providing insight into the quality of the legacy software, but also by identifying demarcated pieces of code which the client indicated they’d like to refactor. In addition, we showed this customer how to do this and monitored progress along the way to ensure quality standards were met.

A digital future for finance

Going forward, multiple forces will continue to shape the behaviour of financial and banking organizations. In order to thrive in the current landscape, financial services firms will have to embrace digital transformation rapidly.

That means reliable, high-quality IT is of the essence, whether the focus is on providing customer intimacy for banking and non-banking functionality; delivering top-notch products as a highly-specialized firm within the industry’s full value chain; or serving as a lean and mean high-volume transaction processing factory.

The organizations who can successfully leverage new technologies to improve customer experience will also be the ones to successfully restore their reputations and revenue. SIG is ready to help with that.

Author:

Principal Consultant Solutions, Benelux

We'll keep you posted on the latest news, events, and publications.