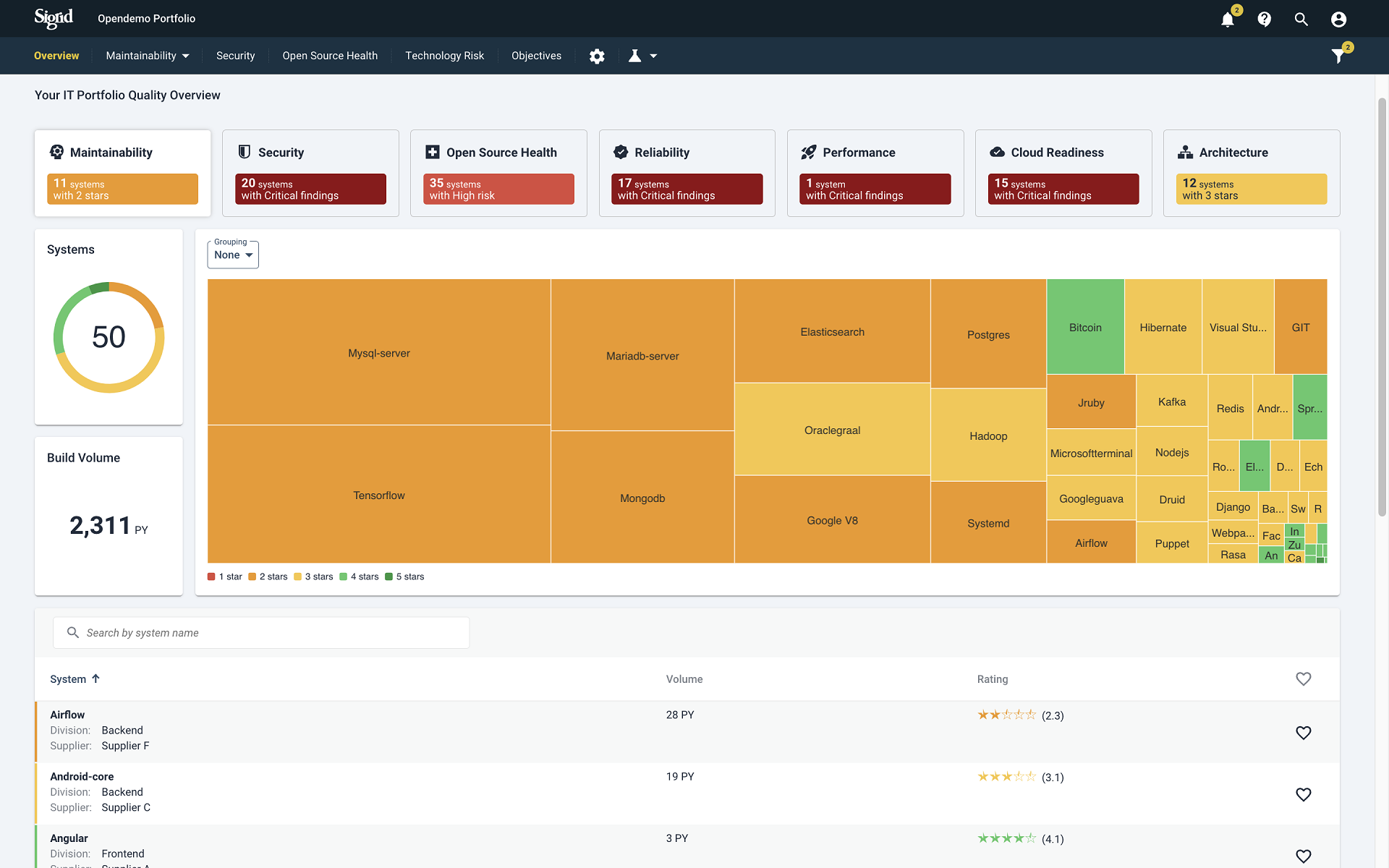

Meet Sigrid, the all-in-one software insights solution. It continuously monitors your portfolio companies’ software assets, pinpoints value-creation opportunities, and steers you toward higher exit multiples.

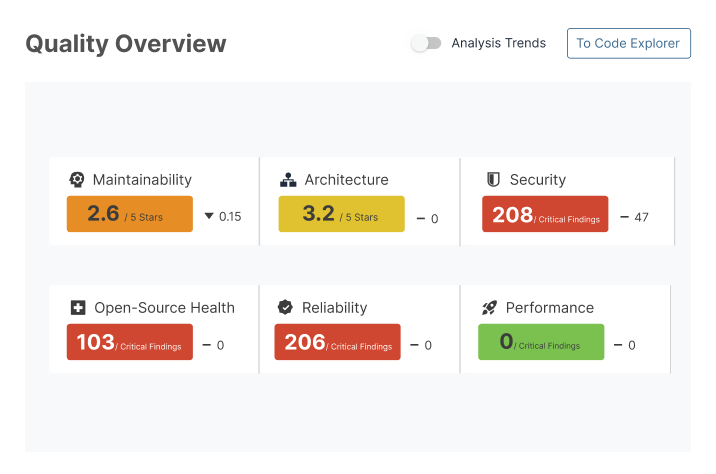

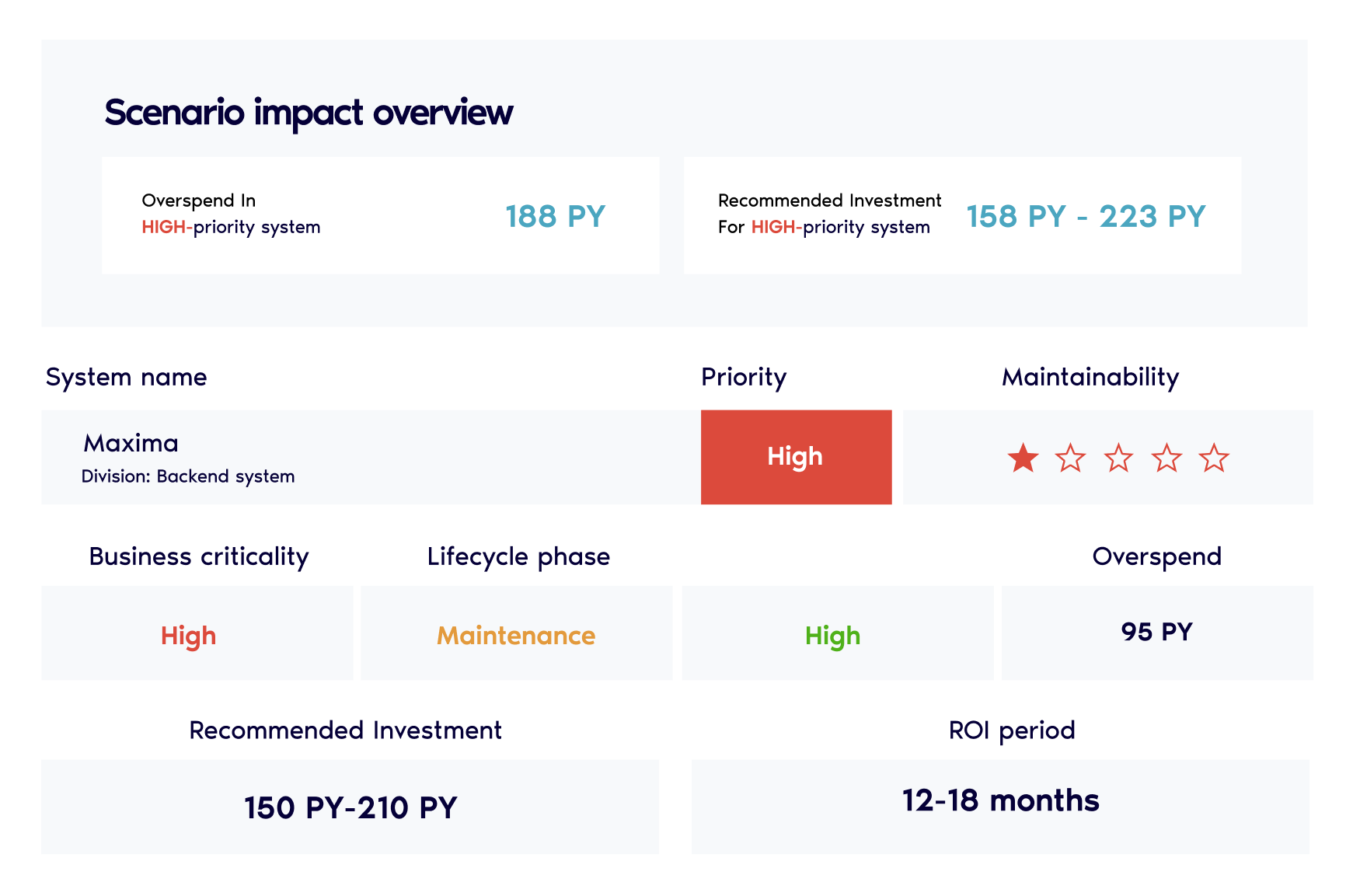

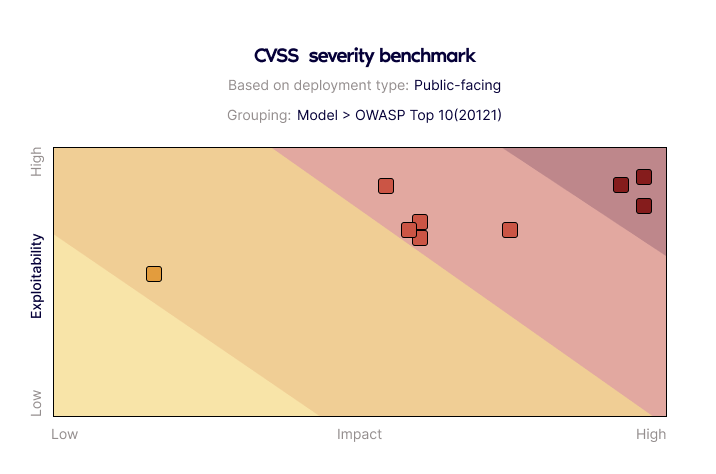

Analyze the software assets of a potential acquisition and identify hidden investment risks and opportunities. Discover how the underlying technology impacts the investment thesis objectives and the growth of the business.

Sigrid continuously monitors your portfolio company’s proprietary software assets to ensure you can optimize for growth and efficiency. Generate value sooner and avoid risks that require additional capital or extend the hold period.

The software of a portfolio company directly drives business value. Resolve issues in advance and anticipate buyers’ concerns. Develop and present a unique value proposition backed by evidence and fact-based insights.

“We recommend that you continue to monitor the quality of the software on an ongoing basis, even in the post-merger integration process, to ensure you’re integrated into their processes and to ensure that they will have a well structured and well maintainable code base.”

– Giles Shrimpton, Managing Director Automotive at Eurowag

Private Equity firms who take a holistic approach to their investment strategy and have visibility into the performance of a portfolio company’s software assets can maximize value at every stage of the deal cycle.

Billion lines of code analyzed

Technologies scanned

System inspections performed

Million lines of code analyzed weekly

Notifications