24 July 2024

Request your demo of the Sigrid® | Software Assurance Platform:

4 minutes read

Written by: Nick Potts

Amidst economic volatility, escalating competition, and heightened stakeholder demands, private equity operating partners need an effective value-creation strategy.

In the face of such uncertainty, an innovative method of value creation in private equity that quantifies the potential upside and the associated costs at every deal stage becomes the linchpin to success.

Today, more than ever, companies rely heavily on their technology stack. This intricate layer is challenging to navigate. Private equity operating partners skilled in dissecting technology and pinpointing critical issues at every deal stage find themselves on the pathway to success.

Private equity operating partners need visibility pre-acquisition. This aids in understanding the risks and ensuring value investing in private equity is maximized. A thorough static code analysis helps in determining the true economic worth of a target’s digital assets, strengthening their negotiation position.

Beginning their value creation strategies early, a private equity team, much like the finance team, will embark on their search for value before a deal. They will conduct a comprehensive audit of a company’s software at the source code level. Such an analysis down to the code lines reveals hidden risks and opportunities crucial for an effective value creation plan in PE. IT Due Diligence includes:

Mature your M&A Process to accelerate value creation. Analysis of digital assets can uncover hidden risks and opportunities that can impact the valuation and projected growth of an acquisition. Even when software isn't central to a deal it can still provide significant value with the right due diligence and post-merger integration. Jasper Geurts, Director of US Consulting at SIG, and featured guest Bobby Cameron, Vice President and Principal Analyst at Forrester Research, discuss the key strategic questions that must be addressed to maximize value throughout the digital deal lifecycle. Does the technical roadmap align with your strategic objectives? Is the IP legitimate and protected? Is the software free of security, privacy, IP, and maintenance risks? Will the software integrate seamlessly into your current infrastructure? Can it scale to meet your growth targets?

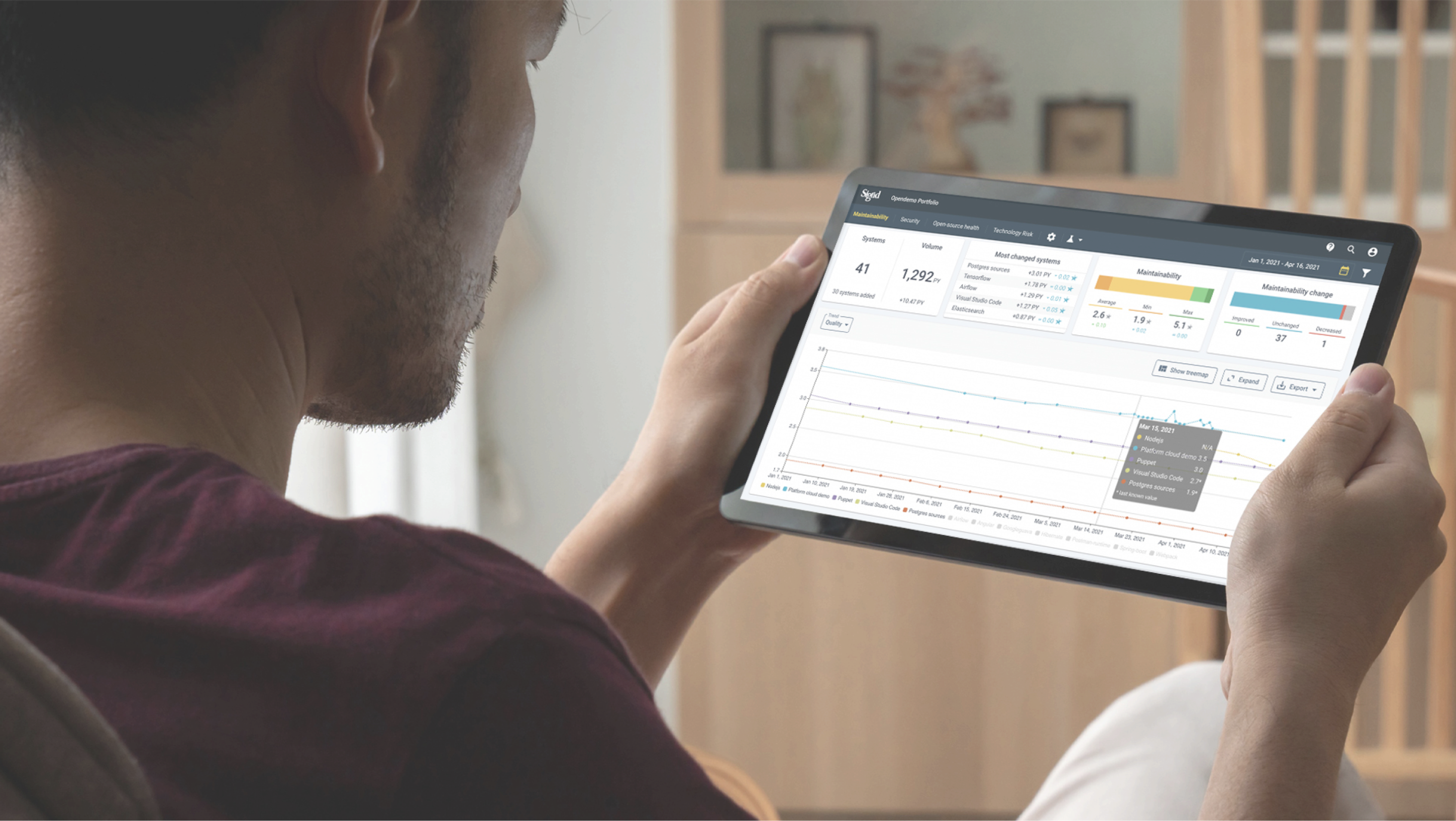

Constant monitoring of software assets is essential to keep investment goals aligned and to prevent unforeseen risks that might necessitate added capital or extend the hold period. Derive in-depth technical insights to ensure the necessary measures are undertaken for optimizing returns.

Transition seamlessly from IT Due Diligence to value creation strategies. With data-derived insights, gauge the flexibility of a company’s tech stack. Then, have a digital transformation roadmap in place, detailing the associated costs. This proactive approach allows PE firms to swiftly integrate new acquisitions into their larger portfolio, aligning software with the broader private equity value creation objectives.

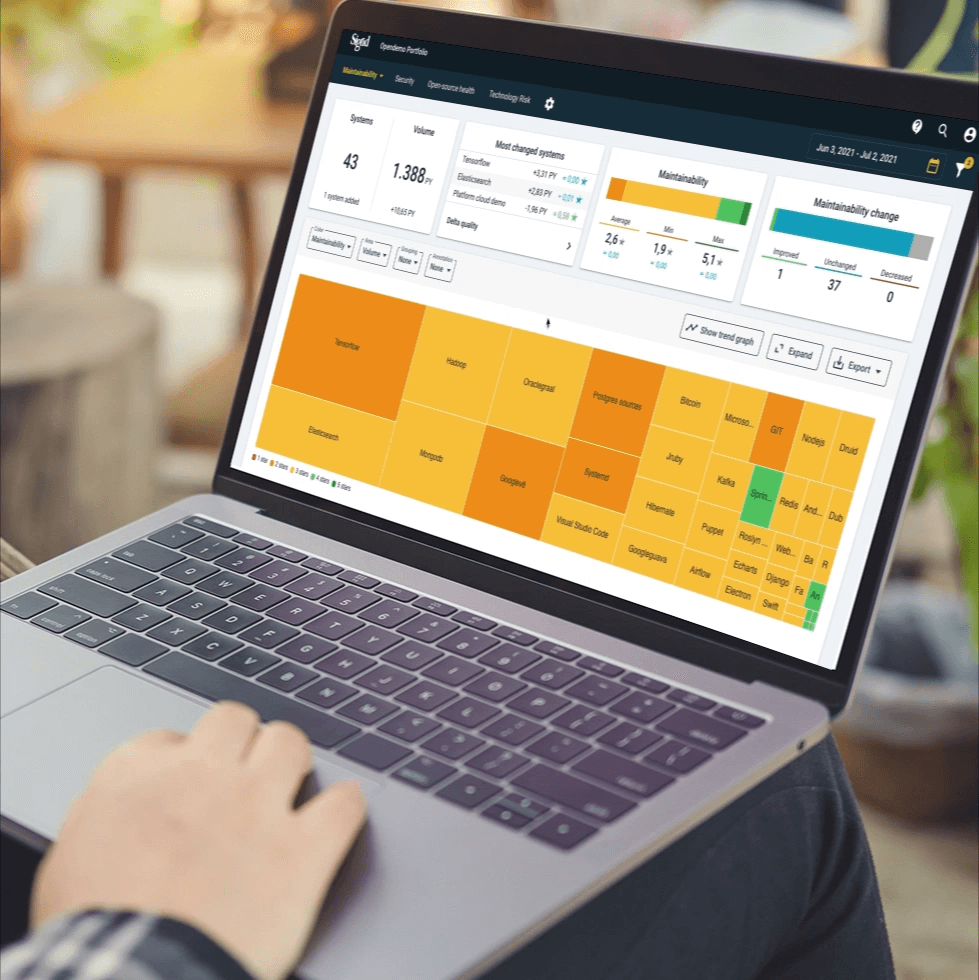

To aid in this, a software monitoring platform like Sigrid® can be invaluable. It helps PE firms implement robust reporting from day one. Such platforms enable continuous assessment of software performance, ensuring transparency and alignment.

Identifying opportunities and potential risks is crucial when you’re looking to enhance business value. By anticipating buyer concerns and crafting a data-backed value proposition, you present the company in the best light. This preparation, or exit readiness, ensures that any potential issues are addressed well before any transaction discussions commence.

Continuous monitoring naturally guides technology toward being exit-ready. All efforts during the ‘invest’ and ‘grow’ phases should sync with the investment thesis. For a successful exit and maximum ROI, some additional resources and assessments might be needed. The software should align with the intended exit strategy, and having supporting data validates the PE firm’s approach, preparing companies for due diligence in the upcoming months.

The role of technology in business growth has undergone a sea change in the past decade, evidenced by rapid advancements like AI. When PE firms understand their target software’s nuances and recognize opportunities within their technology, the impact on private equity value creation can be profound.

By embracing a holistic approach, PE firms can delve deeper into their portfolio companies’ digital assets. This end-to-end approach, right from the onset, helps in unearthing hidden value creation opportunities, tracking progress throughout the holding period, and guiding companies to be ready for exit sooner, offering a competitive edge.

Author:

Growth Marketing Manager

We'll keep you posted on the latest news, events, and publications.