24 July 2024

Request your demo of the Sigrid® | Software Assurance Platform:

4 minutes read

Written by: Nick Potts

Private equity operating partners need to proactively mitigate software risks to maximize value. Continuous assessment of the software infrastructure and systems within the portfolio companies is a fundamental practice that enables a more profitable approach to effective portfolio management at every stage of the deal lifecycle.

Software is constantly evolving and responds to new customer demands and market trends, understanding the performance of your portfolio company’s software ensures your investments stay on track with the strategic objectives. By continuously monitoring the total software exposure Private Equity Operating Partners can gain a deeper understanding and make informed investment decisions from acquisition to exit.

SIG has worked closely with numerous Private Equity firms since we were founded in 2000, and we see a growing trend towards an approach to portfolio management that looks at the software as an untapped opportunity that can create significant value.

Regularly tracking and evaluating the performance and security of the software systems within portfolio companies helps identify vulnerabilities or potential issues that could impact profitability. By actively managing software exposure, operating partners can reduce costs associated with system failures or breaches while safeguarding the value of their investments.

It’s common practice that analysts continuously examine a company’s financials and operational efficiencies. Why not analyse the digital assets a business depends upon to grow?

Mature your M&A Process to accelerate value creation. Analysis of digital assets can uncover hidden risks and opportunities that can impact the valuation and projected growth of an acquisition.

Even when software isn't central to a deal it can still provide significant value with the right due diligence and post-merger integration. Jasper Geurts, Director of US Consulting at SIG, and featured guest Bobby Cameron, Vice President and Principal Analyst at Forrester Research, discuss the key strategic questions that must be addressed to maximize value throughout the digital deal lifecycle.

The earliest point PE firms can get visibility into a target’s software is during the due diligence phase. An IT Due Diligence dives into the source code as it contains a wealth of information, and should go deeper than the typical technical interviews and documentation review. An assessment of the current state of technology will identify security vulnerabilities and expose potential issues that could impact the company’s operation, reputation or potential integration. More importantly, it can uncover hidden opportunities, evaluate future scalability and forecast ongoing maintenance costs.

By analyzing the code, partners can get a handle on how aligned a target company’s software supports a PE firm’s value creation plans. For example, the SIG team identified that an innovative transportation startup was using open-source software without appropriate licensing. This helped the PE firm provide a list of terms to offset the risk and the target company was able to resolve their legal obligations avoiding the possibility of incurring substantial fines.

PE firms should not overestimate the value of IT Due Diligence: it is a snapshot of the state of the technology at the point of acquisition. Post-acquisition a proactive strategy of continuous monitoring of the software risk should be implemented to ensure the most pressing findings are implemented. PE firms can track that ongoing development is aligned with the investment thesis and value-creation plan.

“We recommend that you continue to monitor the quality of the software on an ongoing basis, even in the post-merger integration process, to ensure you’re integrated into their processes and to ensure that they will have a well-structured and well-maintainable code base.”

Giles Shrimpton, Managing Director of Automotive, Eurowag

Software portfolio monitoring empowers PE firms to add greater value to the software assets and avoid risks that require additional capital or extend the hold period. Automated measurements ensure the target company’s team can meet software performance KPIs that increase resilience and ensure the software enables investment success.

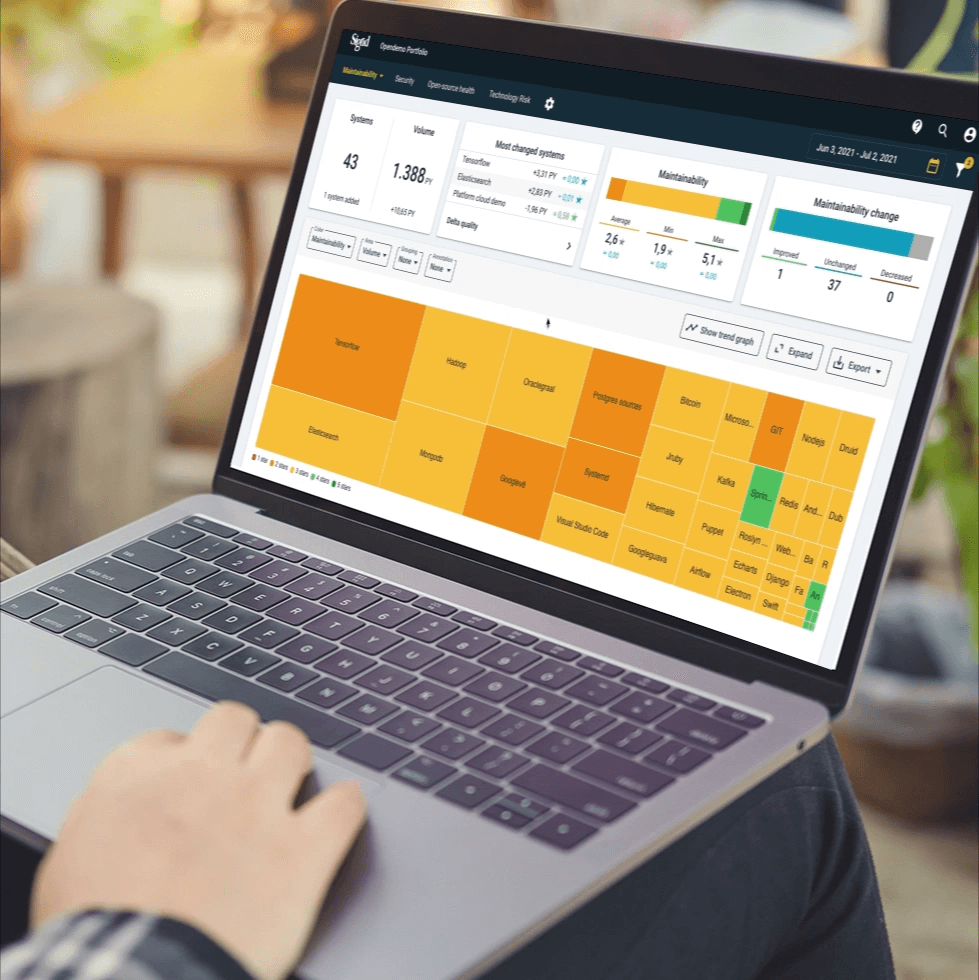

Using Sigrid®, our software performance and security management platform, portfolio companies were able to improve the quality of the software, fix bugs quicker and resolve more security vulnerabilities. This freed up developer capacity and meant a PE firm could perform better without increasing headcount, resulting in lower operational costs and higher EBITDA.

A successful exit has many elements, a clear and evidence-backed equity story detailing the asset’s potential and why it represents an exciting investment opportunity may be the most important. Exit readiness is the most effective way to assemble the necessary evidence to reinforce the exit story concerning the software. The digital assets of a company should go beyond delivering a smooth IT service, they should enable future growth for a potential buyer.

“There is a difference between working towards an exit and having what needs to be in place to support the exit.”

Guillaume Cazalla, Partner, McKinsey (PE Exit Excellence: Getting the story right)

Much like financial debt can impact the company’s exit value, software accrues technical debt which can impact a buyer’s capacity to implement their own strategic objectives. All past technology choices can either accelerate development, innovation and growth – or slow everything down. Left unaddressed, this results in lower valuation during exit.

Continuous portfolio monitoring will enable a PE firm to take a data-driven and systematic approach to increase the value created during the holding period and to protect the value of the software at the time of sale. Software quality is now a fundamental component of the exit story which can be reinforced with evidence and is now critical in sustaining returns for PE firms of the future.

Software is critical for the growth of a company, as businesses rely upon their technology to increase revenue, service customers, and scale operations. The fundamental nature of software is forcing PE firms to change their approach to managing this risk, which can be challenging to assess and monitor. Mitigating the software risk within your portfolio company’s technology isn’t a one-off process, it is fundamental to the investment thesis and value creation plan and requires continuous monitoring throughout the deal cycle.

Author:

Growth Marketing Manager

We'll keep you posted on the latest news, events, and publications.